As of 1 January 2024, non-residents with property rented in Spain will be able to file an annual TAX return

Ministerial Order HAC/56/2024, of 25 January, establishes substantial changes in relation to non-resident returns for property rentals.

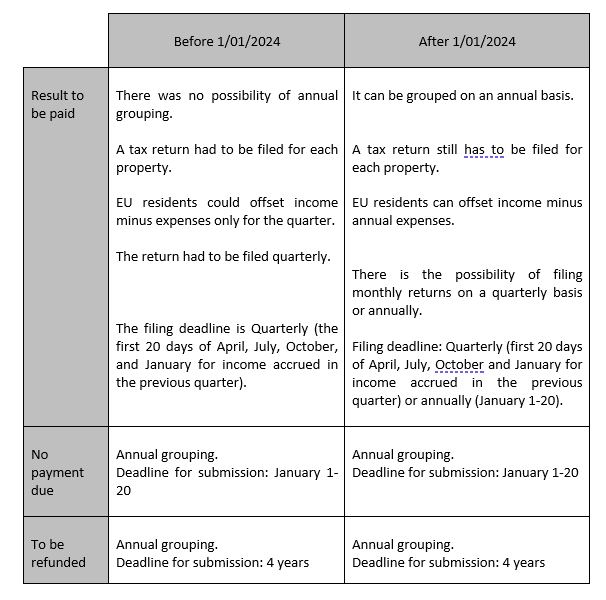

Until the publication of this Order, non-residents with real estate rented in Spain had to file a quarterly return per property in cases where the result was to be paid.

As of January 1, 2024, the possibility of grouping annually the income derived from the lease or sublease of real estate is established in cases where the result is to be paid.

We attach a link to the Ministerial Order HAC/56/2024: Consult

© La presente información es propiedad de Escura, abogados y economistas, quedando prohibida su reproducción sin permiso expreso.