Definition and obligations of large property holders in Spain and Catalonia

Under Spanish law 12/2023, a large property holder is defined as any individual or legal entity that owns either:

- More than 10 urban residential properties, or

- More than 1,500 square meters of residential space (excluding garages and storage units).

Autonomous communities are authorized to reduce this threshold to 5 properties in areas officially designated as stressed residential markets, provided such a reduction is duly justified.

In addition to individuals meeting the above criteria, the following entities are also subject to registration due to their potential impact on housing availability:

- Financial institutions and their real estate subsidiaries.

- Investment funds.

- Asset management companies.

- Any legal entity that owns more than 10 residential properties within Spain, if at least one of those properties is located in Catalonia.

Catalonia adopts and expands the national definition. According to Law 24/2015 and related regulations, individuals owning:

- More than 5 residential units or,

- More than 1,500 m² of residential land are also classified as large holders. Registration with the Catalan Housing Agency is mandatory.

Large property holders operating in Catalonia are subject to a broader set of legal obligations, including:

- Mandatory registration in the official Registry of Large Property Holders.

- Immediate notification to the Catalan Housing Agency upon meeting the criteria, specifying whether the classification is based on the number of properties or total residential area. If based on property count, the exact number of units must be declared.

- Requirement to offer social rental contracts prior to initiating eviction or foreclosure proceedings, and during property transfers in stressed residential areas.

- Potential compulsory transfer of vacant properties to the public housing stock

- Sanctions and possible expropriation of use in cases where the social function of housing is not fulfilled

The regional government in Catalonia enforces additional administrative and fiscal controls, including:

- Pre-emptive purchase rights (tanteo y retracto) over properties owned by large holders in stressed areas

- Non-compliance with registration or reporting obligations is considered a serious infringement under Catalan housing law

- As of June 27, 2025, property sales by large holders are subject to a 20% Transfer Tax (Impuesto sobre Transmisiones Patrimoniales), with exemptions granted to social housing developers and non-profit organizations

Outside Catalonia, obligations are limited to those established under Law 12/2023. No national registry is currently required, and administrative intervention is less extensive.

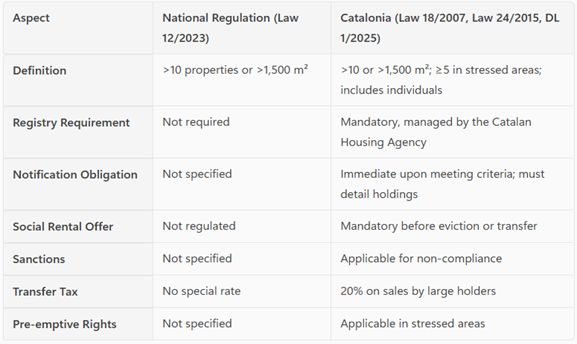

Summary table:

© This information is the property of Escura and its reproduction is prohibited without express permission..